Steady September for garden centres as autumn planting begins

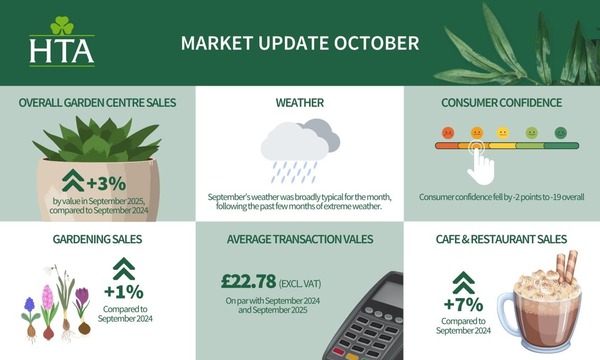

The Horticultural Trades Association (HTA) October Market Update shows that garden centres recorded modest but steady sales growth in September 2025, with overall sales by value up +3% on September 2024 and +7% on September 2023. Although September is one of the smallest trading months for the sector, performance remained solid, supported by good footfall and encouraging early signs of autumn gardening.

Sales volumes grew +4%, slightly ahead of value growth, suggesting that whilst garden centres are still attracting a steady flow of customers, they are choosing lower-value products overall.

Fran Barnes, Chief Executive of the HTA, said:

“September was a steady month for garden centres, with growth in line with expectations for the time of year. Whilst our report is an average across the sector, we do know that performance varies significantly between retailers due to September being one of the smallest trading months for garden centres. While overall sales were up +3% compared to last year, the real story lies in the mix of what customers are buying.

“Gardening categories were relatively stable, up just +1% year-on- year and down slightly on 2023. Live plant sales edged up on 2024, though hardy plant sales were around 10% lower than two years ago. However, bulbs and seeds performed particularly well, up 7–8% on last year and 17% ahead of 2023. This reflects a healthy appetite for autumn planting, supported by the warmer, wetter conditions that created ideal growing weather.

year and down slightly on 2023. Live plant sales edged up on 2024, though hardy plant sales were around 10% lower than two years ago. However, bulbs and seeds performed particularly well, up 7–8% on last year and 17% ahead of 2023. This reflects a healthy appetite for autumn planting, supported by the warmer, wetter conditions that created ideal growing weather.

“Non-gardening areas were the main driver of growth again this month, rising +7% on 2024 and +17% on 2023. Gifting, indoor living, and food & farm shop products all did well, and catering sales rose +7% compared to last year. Together, these categories continue to add strength and variety to the garden centre offer.

“Average transaction values were unchanged for the second year running. Given the impact of inflation, this shows that shoppers are still visiting and spending, but focusing on smaller, more affordable purchases. Consumer confidence dipped slightly in September, down two points since August, but remains steady overall.

“Year-to-date sales remain comfortably ahead of previous years, at +10% higher than in 2024 and +11% ahead of 2023, putting garden centres in a strong position as we move into the crucial Christmas trading period. That said, businesses typically need growth of 10–15% year-to-date to maintain profits given the rising costs of doing business, and many are still facing real pressure on margins. To help maintain and grow these vital businesses, our Autumn Budget submission calls for urgent support for garden centre businesses, including reforms to business rates, access to investment allowances, and measures that help our members invest in green skills to grow literally and figuratively. With the right framework, retailers can continue to offer great experiences, support local jobs, and help the UK meet its environmental ambitions.”

HTA members can access further insights in this month’s Market Update on our website.

- Log in to post comments